|

I see the question on real estate forums or have people ask me all the time, “I found a property deal, but where do I get the money to purchase a property?” If you're not looking to assign a real estate contract, or you know the house is a real estate deal but might take a few weeks to sell, then you want to buy the property. Where do you get money to purchase this property?

I’ll discuss a few examples of ways to use your own money and other people's money that we've utilized in the past. First one is ways to purchase properties using your own money. You might have a self directed IRA that you could use. In your IRA most people purchase mutual funds, stocks and bonds. Maybe you subscribe to a self directed IRA where you can invest in anything such as real estate. A lot of people utilize this, and it's a great way to grow your retirement accounts. Another way is if you don't have much debt on your personal property and it's worth a lot of money, you could pull out a home equity line of credit through a bank. $50,000, $100,000, $200,000, whatever your equity is on your property. Interest rates are real low rates right now and it's interest only payments when you use your HELOC. So you could utilize six figures from your own personal property to purchase investment properties that you can purchase and quickly wholesale, or maybe do renovations and resell, or buy them as rentals. If wholesaling or rehabbing, when you sell your property you can repay the HELOC and get ready for the next deal. If you purchase the investment as a rental, then after you fix it up and have it rented, you can refinance and pay back your home equity line of credit. You might have savings accounts that you can use to purchase properties. If you have permanent life insurance, there's usually cash value within your policy. That's a quick way you can get money in a few days. It's the savings account within your permanent life insurance product. So those are a few examples just from your own money that you might have access to purchase properties to wholesale or as an investment property. Now let's discuss other people's money. So some of the ways that we have utilized is transactional funding. Transactional funding is used when you purchase the property and a week later, or same day or a month later, you resell the property. It varies with what people or companies charge. Anywhere from $500 to $1,500 to use transactional funding on a short term basis for a few days or a few weeks. Another way to use other people’s money is hard money lenders. They're going to cost a little bit more, however, you're going to still make money on it. Hard money lenders usually charge points and there's going to be higher interest rates. Anywhere from 10% to 15% on average. And another example to use other people’s money is to get a business line of credit in your business that you have as an opportunity to purchase properties. And then finally one that we utilize a lot is private lenders. Private Lenders are just individuals that have plenty of money in savings, and they don't want to earn 0% interest in a bank account somewhere. You meet these people through networking such as real estate investment groups, country clubs, cocktail parties. We just talked to people about what we do and people are interested and they want opportunities to get into real estate without actually actively managing projects. This is a great way for them to diversify their portfolio and invest with real estate investors such as ourselves. These private lending deals vary significantly. It could be tied to an individual house where you use a mortgage and note on the deal to protect the private lender's investment. Some private lenders are okay with receiving quarterly interest payments from us. They lend us $X amount of dollars and they receive quarterly interest only payments. There are several ways that you could utilize your own money or other people's money to purchase real estate properties, whether it is for wholesaling REO properties, where you can't assign a contract, or if you are purchasing from a homeowner and you can't find that buyer right away, but you know, it's a deal and you don't want the contract expire. You could close on the property and then resell it a little bit later and still make money on the property and not have that contract expired with the buyer. So hopefully these ideas are helpful and better answer the question I Found a Property Deal But Where Do I Get Money to Purchase the Property? If you want to learn more visit a video on this topic at https://youtu.be/84HFqN_m9eY.

0 Comments

In this blog I will tell you about how to sell a house by owner. This means you will sell your house as a For Sale By Owner (FSBO). So without a realtor or real estate agent and sell your house by yourself.

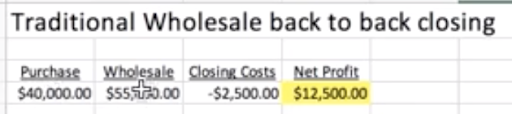

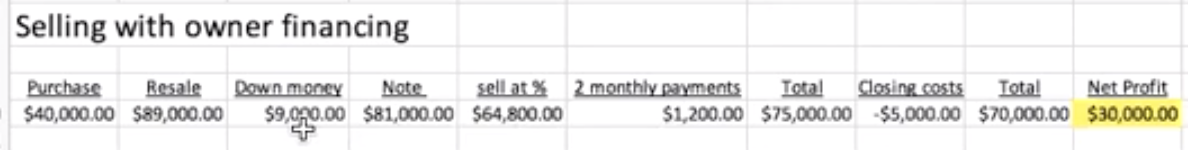

We do this all the time, selling our investment properties for sale by the owner (FSBO). Me and Paul will go into a new real estate market and we will have zero cash home buyers in that real estate market. Once we have the property under contract and the lockbox code, we will start our marking system. Sometimes we find a cash home buyer in a few days, where we could do a back-to-back closing for a virtual wholesale deal to minimize our holding cost. Here is a high-level of the online and offline marketing that are utilized when we sell our houses for sale by the owner. FSBO is the way we sell most of our investment properties. We don’t use real estate agents to list our properties often. First I will cover the offline marketing. Offline Marketing •Call real estate investors from your database •Find & Call new real estate investors •Local REIAs •Newspaper classified Ad •Mail to target list •Wholesalers & real estate agent with buyers •Follow up First if you are already established in your real estate market, then call real estate investors from your database. I have my virtual assistant, if we are new to a real estate market, use Google search keywords on “buy house city”, “sell house fast city”, etc. It is a way to find local wholesalers and real estate investors. The virtual assistant gathers the contact info and they email and call the real estate investor about my property for sale by owner (FSBO). It is another way to add cash buyers to your database for future properties that you want to sell. We also go to the local REIAs in person to network. Or you can get contact information of the people in the REIA whether they're advertising in the REIA newsletter or a board member. See if they're interested in purchasing your property. Another great example is I post newspaper classified ads in certain markets. For example, we sold a few properties for sale by owner this year in Wyoming, Montana, and Pennsylvania using newspaper classified ads. Newspapers are a great marketing resource, especially in rural real estate markets. People still get the newspaper and find properties for sale through their local newspaper. We also mail to a targeted list called landlord list. Owners that do not live in the house (separate mailing address from property address). We also get a cash buyers list that we will mail to as well. Talk to other local wholesalers and real estate agents. For example, you can email several real estate agents in the local area. Tell them that you will pay 2 or 3% commission, if the real estate agent has a home buyer for your house. Finally, follow up is important. Not everyone will call you back as they are busy. So after someone visits the house, call them to see if they visited and want to make an offer on your property. Another example is do not mail just one round of postcards. I have sold many houses on my second or third round of mailing postcards. That covers offline marketing, now I will shift to online marketing to sell your property by owner. Online Marketing •Your Website •Zillow / Trulia (FSBO) •Craigslist •Facebook Marketplace •Post on your social media accounts •Join and post to REI groups and house for sale groups •Email real estate investors from your database •Find & Email new real estate investors •Post on REI forms (BiggerPockets) •Follow up I post my properties for sale by owner (FSBO) on our own website, www.HouseDealsAmerica.com. Other great sources are Zillow and Trulia, where you can post it as a for sale by owner (FSBO). Craigslist works great for certain real estate markets. Many people will go to Craigslist to find property for sale. Something that is coming up and becoming more and more effective is Facebook Marketplace. Like Craigslist, it doesn't work in all real estate markets but it's coming on par with Craigslist. We sold several this year through Facebook Marketplace and Craigslist. Post your house for sale by owner on all your social media accounts. You can join local groups on Facebook. If there's a local real estate investor group go join it and then post your property for sale. You can find cash buyers here as well that you can add to your database for future properties for sale. There are also real estate for sale groups that you can join and post your properties for sale. You should email cash buyers in your database about your property for sale. This is kind of offline and online marketing. As mentioned earlier, I have my virtual assistant pull new potential investors Google searching and looking online for real estate investors. I will email them and call them about my property for sale. If your pro member on certain real estate forums (like BiggerPockets), you can post your properties for sale. The key to online marketing is follow up and being persistent. Don’t just send one email, don't just make one post on Craigslist or Facebook. Renew your online ads, and constantly follow up with people. To learn more visit https://youtu.be/oTBj-yuoKIQ Owner Financing Real Estate Explained! Case Study: How we Owner Financed an Out of State Property8/8/2020 Today we are going to discuss how to maximize your profit on a property. If you are like a lot of real estate investors out there and don't have a lot of deal flow currently, you need to maximize what you can on each property. I am going to discuss how to maximize your profits using seller (owner) financing as opposed to just doing a regular old straight cash wholesale deal. Let's review and break down a property in Texas that we purchased. It is a double-wide property on 5 acres. We purchased for $40,000 and could resell it (wholesale) for $55,000. A real estate investor is either going to keep it as a rental or do a Fix and Flip with the property. After closing costs our net profit would be $12,500. However we want to maximize our profits and on this property and what we decide to do is sell this with owner financing. Texas is a great state to sell houses with owner financing. Texas is a great state to just be a landlord or a mortgage holder. We sold for $89,000. We collected $9,000 down which creates a note for $81,000. We will hold this note for a couple of months (collect the monthly payments). It's $600 for principal and interest each month. We collect an extra $1,200 in monthly payments. Then we are selling the note at 80% of the value, which is $64,800. You add $64,800, plus the $1,200, plus the down payment of $9,000, and the total is $65,000. Now a realtor brought us a buyer so we have some commissions to pay plus closing costs. That will decrease our total number to $70,000.

That puts our net profit at $30,000. Which is 2.4 times higher than it we wholesaled the property for a cash offer. Instead of making $12,500, we are making $30,000 net profit. If you don't have a big deal flow currently and you want to maximize profits, this is an out of the box way of maximizing profits. This is definitely a great method to utilize to increase your profits on each deal. I'd much rather have $30,000 vs. $12,500. Hopefully this is something you can utilize in your business. For more information on this visit https://youtu.be/FGoLwJDu2Zw |

Paul & MichaelWe buy and sell real estate virtually all over the United States! Archives

July 2024

Categories |

RSS Feed

RSS Feed